Price Action Trading Course

There is always a huge opportunity to make money from trading. However, success comes to only those people who work smart. Trading is not just about investing money and watching the charts, indicators or listening to trade advisors. It is about using the right strategies and analytical ability to make wise decisions. Success in trading is not something that you can achieve with your luck; rather it is a skill that can be acquired through proper learning. The best strategy is the one that gives consistent profits on your investment and that strategy is none other than Price Action Trading.

Buy Now

What Is Price Action Trading?

The trading market depends on the movement of prices based on the action of buyers and sellers. Price action trading is a strategy where the traders take their buy and sell decisions based on raw price data instead of other 3rd-party indicators or news. This is a wise strategy that helps traders to make consistent gains from the trade market.

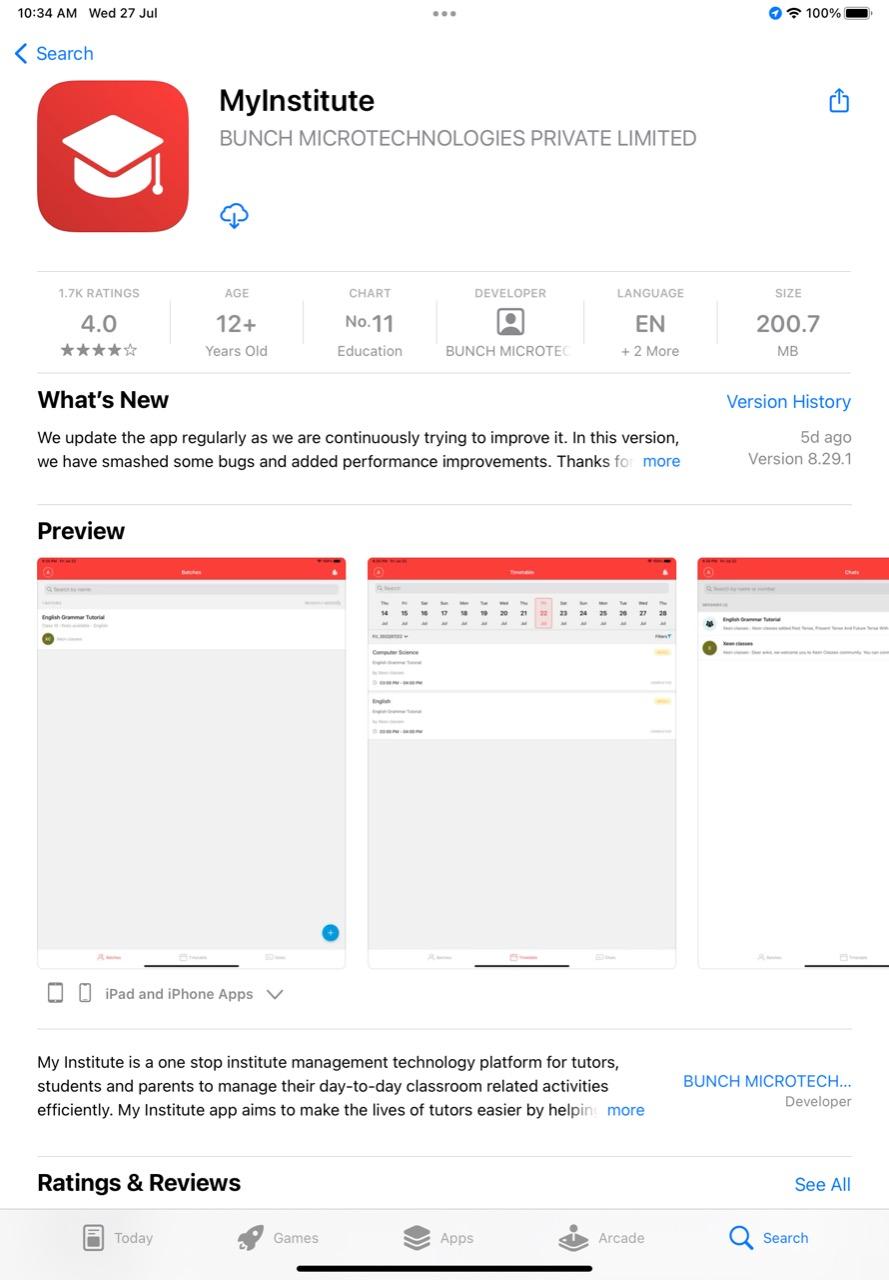

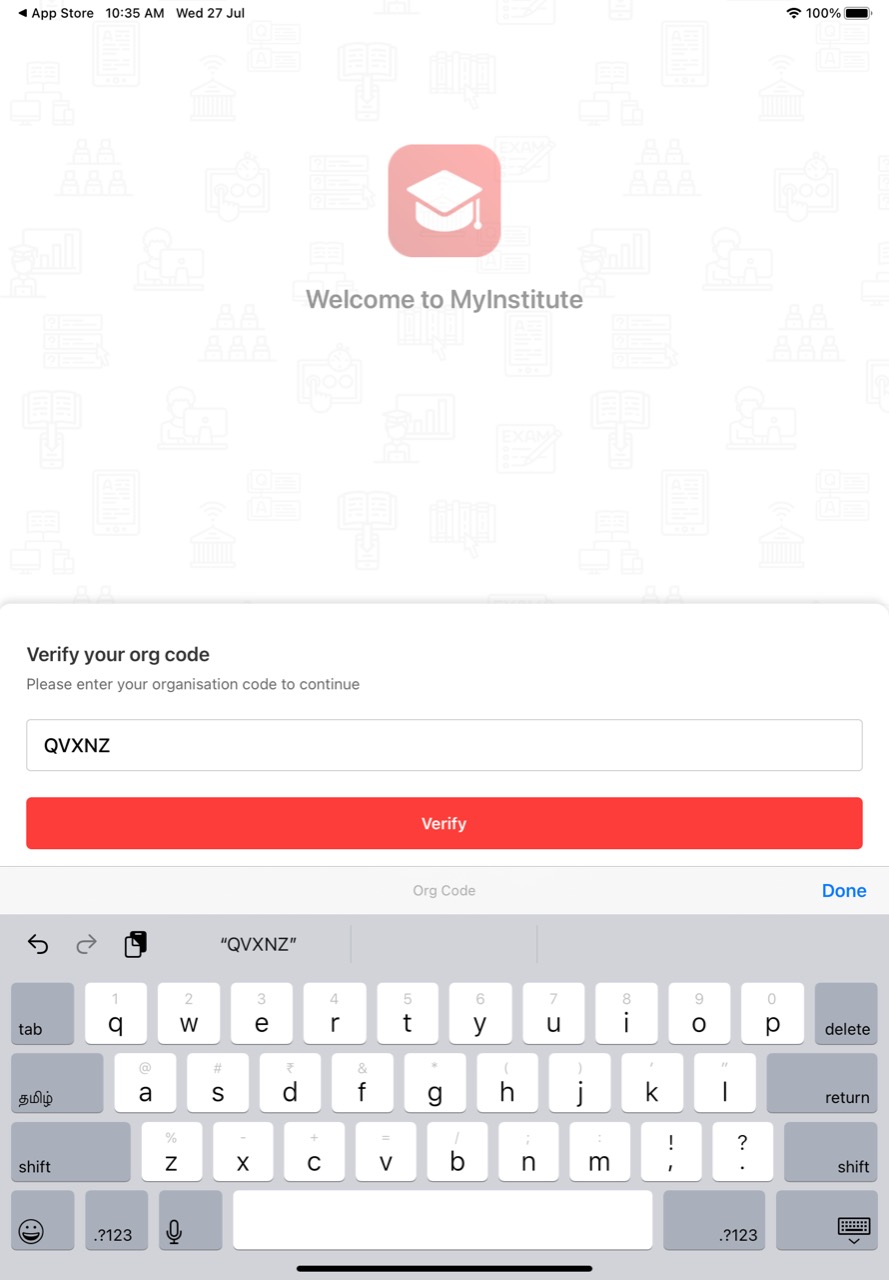

However, there is uncertainty on the price movements and the same strategy cannot work across all market conditions. Thus, you can take the price action trading course from Trade Achievers to learn about the strategy and apply it in your trading.

What Makes Our Price Action Trading Course Unique?

No boring lectures – Interactive sessions

Classes in English and Tamil

No impractical theories or approaches taught

Strategies that enhance your profits

Extraordinary ways of analyzing and interpreting charts

Online Q&A sessions for doubt clarifications

Continuous support and guidance

No outdated or unrealistic techniques

Benefits

- You will learn the fundamentals of our profitable trading system

- You will learn from the basic to the advanced levels on how to read price charts and trade in an easy way

- You will be able to identify proper entry and exit points

- You will learn about trading psychology

- You will learn to use various methods and trading tools to track the movement of the markets

- You will be able to determine the trend in which the prices are moving

- You will know the inside out of the execution of the trading system, irrespective of the market sentiment

- After completion of the course, you will be able to learn how to trade with confidence in a safe environment with no risk

Topics covered in the course are:

Fundamental Analysis

- Basics of Equity & Derivatives (F&O)

- Basics of Commodity

- Basics of Forex Market

- tradingview.com & investing.com

- Time Frames

- Fundamental Sites

- Sentimental Analysis

- Line Chart

- Candle Sticks

- MWPL (How to choose Scrip)

- Money Management

Technical Analysis

People involved in stock market trading would have come across the quote, “Trend is your friend” many a times. But Most retail traders have problems with identifying the market trends. Even if they identify the trends correctly, they cannot use them properly as they don’t know the rules for trading using trend. We teach trend analysis with proper rules.

Trends in the markets are not permanent, they change over time and the ability to identify trend reversals is important for trading success.

market movements create wave structures and trading these types of wave structures helps us in maximizing our profits. Every asset class traded in the market, undergoes correction because of various reasons like profit booking and an idea about these waves help us to trade them efficiently.

This is a very vital and commonly misunderstood concept about stock market trading. Many traders tend to believe, support and resistance is about drawing lines in charts, which sadly is not the case. Understanding concepts thoroughly is important to excel in the subject. We provide proper guidance about plotting and trading using support and resistance.

Markets move because of Institutional trading activities, which every retail trader should be aware of, if not, they can be easily manipulated. Knowledge about these supply and demand zones help in placing our stop losses properly.

Analysis of Charts should be done over different time frames to get a clear picture about what the market is doing. There is a specific set of time frames in which should be used, which will be taught in the session. Identification of trend reversals also revolve around this crucial concept.

These are dynamic forms of Support or resistances, which when combined with trends offer potential for profitable trade setups. With our experience, we have formulated the rules for trading using these exiting structures.

Channels are an improvised version of trendlines. These structures are combination of support and resistance for the price, which when properly understood can help us maximize our trading opportunities.

These are the price reversal pattern, which every retail trader should be aware of, as they are very simple to trade. There are certain rules understanding which can give you an edge in your trading.

These are also price reversal patterns. There are different types of these reversal patterns. These patterns have a high hit-rate and offer valuable opportunities for long-term investments with a higher profit potential.

Range bound markets are common in financial markets. Box breakout strategy helps us to understand, where the rangebound markets will break.

The Italian mathematician’s invention which governs the laws of the universe can be put to efficient use for stock market trading. The retracement tool is used to place proper entry points in a trending market.

This tool is also an invention of Leonardo Fibonacci, which is used to properly place our target levels. These are time tested tools which when used properly can help any new trader achieve success in their trading careers.

The Invention of Japanese, provides data about the four important price points (Open, High, Low and Close) prices. Charts comprising of these patterns can be used efficiently, to identify possible areas of price reversals when used in combination with certain rules.

Quick Contact