Options Strategist Course

Trading is more about applying concepts and strategies to make consistent profits. There is no point if you just acquire knowledge about the theoretical side of the trading markets. We being expert traders know what exactly it needs to be a successful trader. Whether you want a long-term or short-term investment, options trading can add value to your existing investment strategies. Options are for investors who are looking to trade with less risk but can yield higher returns.

Buy Now

What Are Options?

Options are flexible financial instruments. It allows the investor to buy or sell the underlying asset at a pre-decided strike price at a specified maturity period. The option can be complicated but gaining proper knowledge and strategies of the options can help cut your losses and enhance your gains. Options trading is prospering amid both individual investors as well as trading companies. This is because it requires lesser investment but generates higher returns while also limiting the risk to your total investment.

If you would like to invest in options, our options strategist course is the best for you. The course gives you an in-depth understanding of options, the stock and index options strategies, as well as an understanding of the explanation of the terms used in options trading. Additionally, our course also lets you know how to use spreads, straddles, combinations, butterflies, condors, and other intermediate forms of options strategies.

What Makes Our Options Strategist Course Unique?

Live trading on Different Stock Options Strategies

Online as well as offline classes

Faculty with 20+ years of experience

Classes in English and Tamil

A complete blend of theory + practicals

Live Doubt-Solving Sessions with the trainer

Exclusive Access to Trading Floor and Discussion Forums

Ongoing support and guidance

Benefits

- You can learn and implement options strategies tailored to different market views and risk tolerance.

- You can set up your very own independent trading system and identify highly profitable trades.

- You can become financially independent with exclusive income-generating strategies.

- You will know about the unique attributes of options and how to think differently when investing in options

- You can know the top options strategies for income trades and how you can build a simple trading system that produces consistent income regardless of how the market is.

- You can build your own options trading strategy with sophisticated approaches to preserve and build capital.

- You will know how to assume option strategies for the next day and control your money or set targets for the month

Topics covered in the course are:

• Delta

• Gamma

• Theta

• Vega

• Rho

• Volume & Open Interest

All these Greek terms represent a certain factor, which affects the prices of an option, The factors which impact, options premium will be thoroughly explained with respect to the perspectives of both option buyers and options sellers.

- Protective Call

- Protective Put

- Covered Call

- Covered Put

- Bull Call Spread

- Bull Put Spread

- Bear Call Spread

- Bear Put Spread

- Long Call Condor

- Short Call Condor

- Long Call Butterfly

- Short call Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Long Combo

- Collar

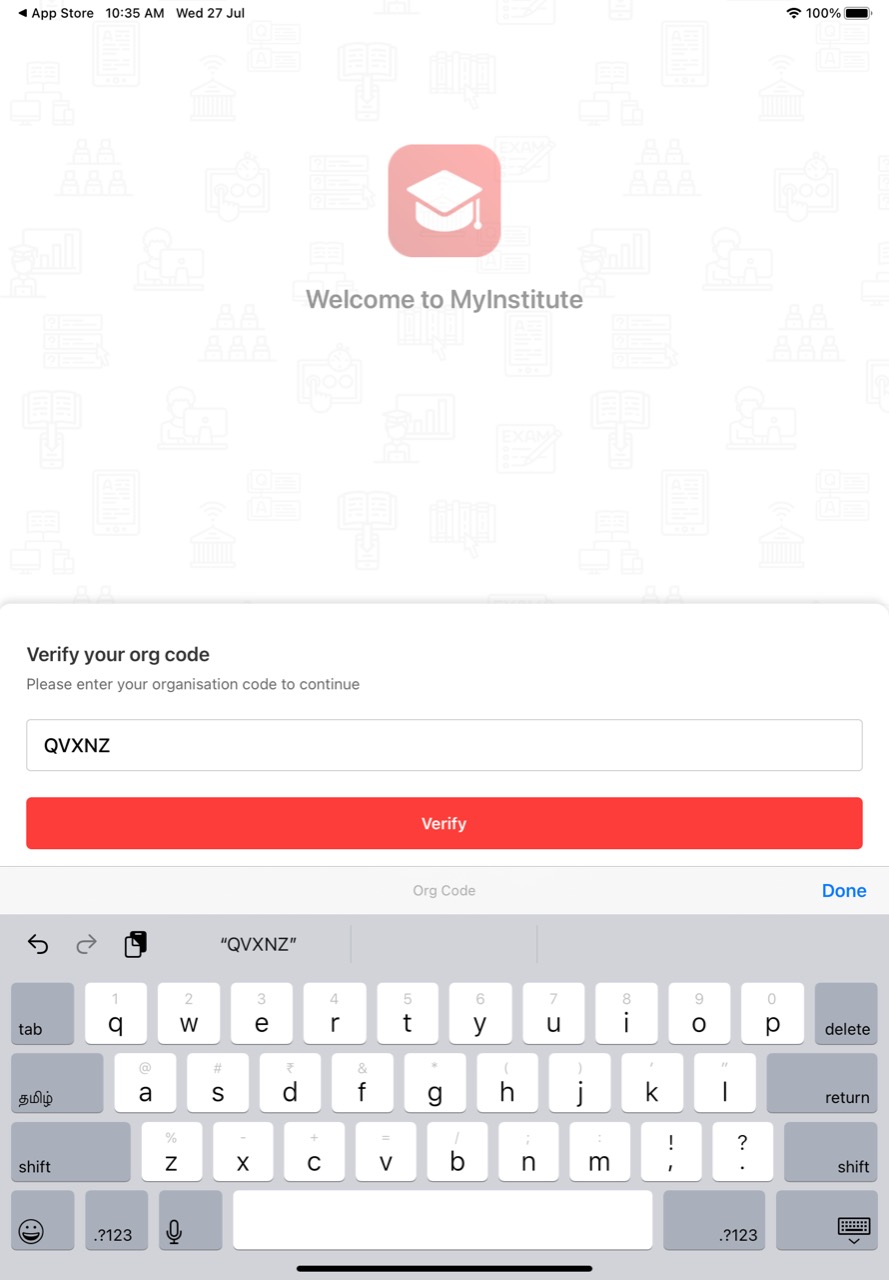

- Conditions Apply: Since Knowledge about technical analysis is necessary to attend this course, only those students who have completed "PRICE ACTION" course are eligible to attend this course.

Quick Contact